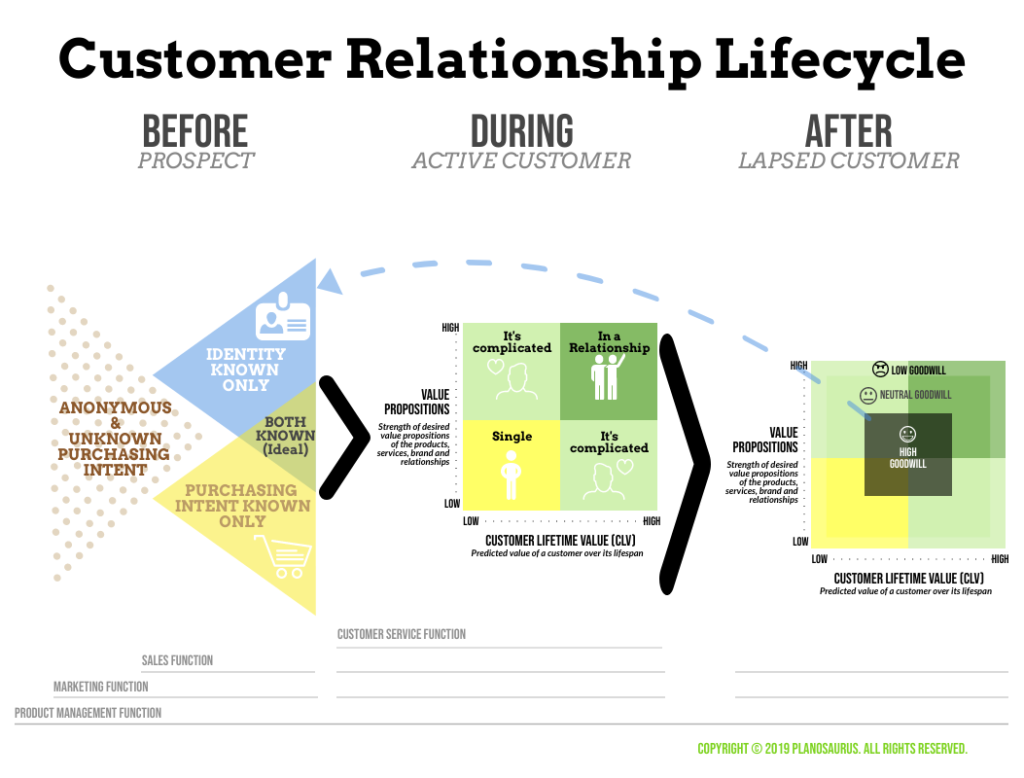

It’s not you; it’s me. For over a century, your traditional sales and marketing funnels were perfect for helping illustrate the path someone takes to become a customer. But the world has changed. Technology has democratized access to information, and that changes everything. Furthermore, it used to be enough to visualize the steps to making a sale. However, I sometimes needed other diagrams to show related processes and components. Sales, marketing, product management, and customer service are so intertwined that I need more.

Look, your traditional sales and marketing funnels are great, and I am sure there are still people you’d make very happy with, but I am no longer one of them. I created a Customer Relationship Lifecycle that addresses the entire process from being a prospect to a lapsed customer, and I know I can use this as the framework for building programs, strategies, systems, and competencies. I’m grateful for our time together, but it is time to move on.

A New Model

Now that it is over, I can say that I always hated the funnel analogy. I have a funnel in my kitchen; 100% goes into the bottle if I pour liquid in. This is not remotely close to how a prospect becomes a customer today. Yet, nearly all the models used in the business are called ‘funnels’ and assume that what goes in all exits as customers. Since we are being real, it’s not the only thing I didn’t like.

Plenty of relevant research tells us that in today’s highly competitive business market, the focus should be building relationships – especially in B2B. Existing models (and frankly, how many organizations run sales and marketing) focus on how one generates a sales transaction from a non-customer. This is a short-term and selfish way of approaching customers.

Traditional funnel stages can vary, but the primary path is generally awareness, interest, desire, and action. What is the difference between interest and desire anyway? Shouldn’t you be able to verify with data where every prospect is at all times? Just because someone watches your webinar, downloads your white paper, or visits your booth at a trade show doesn’t mean they have purchasing intent. Maybe your booth just had excellent swag. This is way more complicated than it used to be.

My new Customer Relationship Lifecycle is a high-level visualization of how a prospect becomes a customer, eventually a lapsed customer.

Updating the scope and objective of the model

Sales transactions should be viewed and managed in a larger context to ensure that the multiple functions, processes, and systems are aligned. The traditional sales and marketing funnels generally only address the stage where a prospect is transformed into a customer. It also focuses on making sales transactions, not building long-term, mutually beneficial relationships. The change in scope for my new model ensures that the objective evolves from a simple sales conversion to a longer-term relationship.

Every type of professional has specific terminology and acronyms bestowed upon them by their education, profession, and employers. You can cut through that by using my trusty lifecycle stages: before, during, and after. (This works for everything because it always helps to speak in plain English instead of industry or buzz words. The only caveat is that you must define the ‘during’ stage so everyone is on the same page.)

Now that we are focusing on the customer lifecycle and breaking it into before they are a customer, while they are a customer, and after they are a customer, we can take a closer look at each of these three stages. There are only two rules here: keep it high level and be able to quantify with data where your relationship is at any given time.

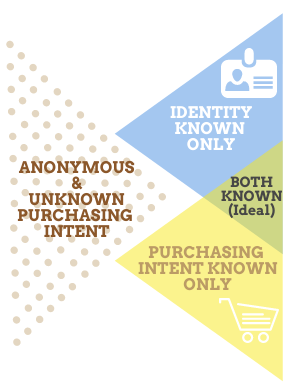

Before

I’d argue that you can simplify all prospect-related interactions (sales and marketing) by quantifying just two things: identity and intent. This system prioritizes who salespeople should reach out to and helps marketers clarify how to work with each of the four groups.

Identity

A billboard reaches people traveling in a specific geographic area, digital ads on a news website reach that website’s audience (which they can provide your details on), and a booth at a trade show will be seen by people in that sector who attend. Yet, you don’t know the identities of these folks interacting with your marketing efforts. Once you know their identity and have their permission to contact them when required (i.e., email marketing), you can interact with them and track it at a more personalized level.

Purchasing Intent

The best way to track intent is to have a prospect tell you directly, “We are planning to purchase a doohickey from someone in the next 30 days.” Alas, we aren’t always so lucky to have a prospect tell us clearly they intend to buy what we are selling (although not necessarily from us).

Instead, we must rely on predictive modeling to help identify the possibility of future outcomes based on the historical data we have (i.e., search history, downloads, # of website visits in a short time, etc.). You can create a simple model by analyzing all your data or a more complex and automated one by purchasing software for you. Either way, you can divide all prospects into those who have demonstrated purchasing intent and those who have not.

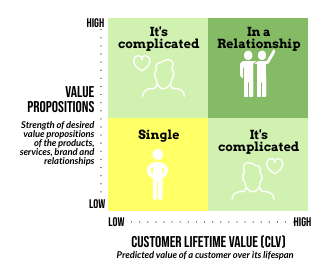

During – Customer

Anyone adapting this model for their own use should first define ‘active customer’ because it can differ. For some companies, whether there is a contract in place or not is simple. Other companies make periodic sales, so they will likely select a timeframe in which sales have been made.

Good, lasting, mutually beneficial relationships are built on equality, with each party giving about the same. This idea is the framework for how I sort customers: value propositions (customer) and Customer Lifetime Value for the Company.

Value Propositions

I sometimes joke that the only things I remember from college are my social security number and psychologist Abraham Maslow’s “hierarchy of needs.” This model resonated with me even then, and I have continued to return to it because I think it can tell us more. I am by no means the only one that feels this. Luckily, some smart researchers have used it as the foundation for extensive and brilliant work identifying various value propositions. Their consumer and B2B buyers models are really useful and were published in the Harvard Business Review.

Now, there are value propositions published by marketing, and then there are the ones that customers experience, which may not be the same. Your customers benefit from your business relationship when the value they feel is strong, relevant, and not easily replaced by another vendor. They may not be transparent about what is most important to them, but they will return to you if you offer them value.

Lifetime Customer Value

Loyalty isn’t a proxy for profitability. The company that renews its $10,000 contract annually may be losing you money. Perhaps they have been with you and are paying much lower rates. Maybe their point of contact is complex and is as time-consuming for the salesperson to manage as other customers with an annual spend of $50,000.

The Lifetime Customer Value (LCV) predicts the net profit attributed to a customer’s future relationship. It helps quantify how much you benefit from each relationship. There are a lot of formulas for creating this metric, and organizations should find one that works best for them. (The Association of Accountants and Financial Professionals in Business recently published an excellent guide on LCV with lots of food for thought.)

After–Lapsed Customer

Even the best relationships come to an end. Sometimes, it’s you, and sometimes, it’s them—customers move on for various reasons. The average customer lifespan varies by product, service, and organization.

I wouldn’t just focus on customers with a high Net Promotor Score. This model is not sophisticated enough to provide many strategies. Instead, I would create a new metric specific to the customer that tries to quantify goodwill or how friendly the customer proves to be. The formula should be specific to an organization, but here are a few factors that could be incorporated:

- Was it them, or was it me? What insight has been documented either way?

- Did they have complaints? Were they resolved satisfactorily?

- Have the products or services they utilized evolved since the last purchase?

- Did they refer others?

- Did they contribute to earned media?

- Did they provide public case studies or serve as a reference?

- Did they pay their bills on time?

- Is their organization of strategic importance?

- How did they rate their customer experience or satisfaction level?

I’ve used dozens of B2B vendors over the years; some I would happily use again, some I would not, and most I am indifferent about. I am always surprised when I end a business (or consumer) relationship, and no one asks me why I am leaving. All organizations should have a system to prioritize which lapsed customers they will try to reengage with. A smart Customer experience management program would include the lapsed customers to benefit from goodwill, mitigate bad will, and, over time, win back some of those who are indifferent.

Now What?

The Lifecycle about provides a generic, high-level representation. Before adopting this lifecycle, you need to define what each of the shapes means for you so that you provide consistency across your planning and operations. You may also require minor modifications based on your business model, especially if you want to create separate versions for each major product/service family. Here are the questions you need to answer and document.

Before (Prospect)

- What demographic and firmographic data must be known about an organization to be considered ‘known’?

- What demographic and/or personally identifiable information must be known about an individual for them to be considered ‘known’?

- What methodology are you using to identify purchasing intent?

- Is there a rating system for purchasing intent?

- What actions do you consider purchasing intent’ in your model?

- During (Active Customer)

- What formula will you use to quantify the strength of the value propositions to each customer?

- What formula will you use to identify the Customer’s Lifetime Value?

- After (Lapsed Customer)

- What methodology are you using to determine the Lapsed Customer’s perceptions of you?

- What are the categories used by the methodology? (i.e., Promoter, passive, and detractor)

- How are you defining each of these categories?

Based on historical data, what is the likelihood that each category will return to Active Customer status within 1 year, 2.5 years, and 5 years? Also, are there differences based on what category of customer they were?

The Customer Relationship Lifecycle is designed to help ensure the building blocks of a great relationship are in place so that it can last for the next hundred years.

The future seems more promising now that a new model focuses on building and sustaining customer relationships. This model can be used to plan marketing strategies, sales enablement, customer management programs, budgeting/prioritization, and more. In future articles, I’ll explore the many ways to use it as a framework.

I’m grateful for all the models before this one because each experience strengthens the next one. To quote Adriana Grande, “thank u, next.”